f you want to buy a one-bedroom condo in Calgary, you need two things: market reality (prices, supply, timing) and condo reality (fees, reserve fund health, document risks). This guide uses late-2025 market numbers to help you choose the right budget, target areas, and a step-by-step buying plan so you can confidently purchase a 1-bedroom condo.

1) What “one-bedroom apartment” usually means in Calgary

When people say “one-bedroom apartment” in Calgary purchasing, they almost always mean an apartment-style condominium (condo)—a unit inside a condominium corporation with monthly condo fees (sometimes called strata fees in other provinces). You’re not just buying the unit; you’re buying into the building’s finances, rules, and long-term maintenance plan.

That’s why condos are not “cheap houses.” A condo can be a great buy, but only if you treat documents and fees as seriously as the price.

2) Calgary condo market snapshot (late 2025)

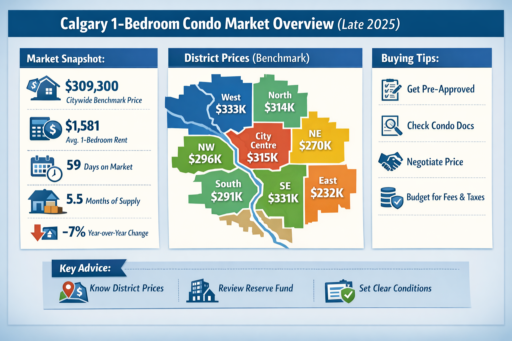

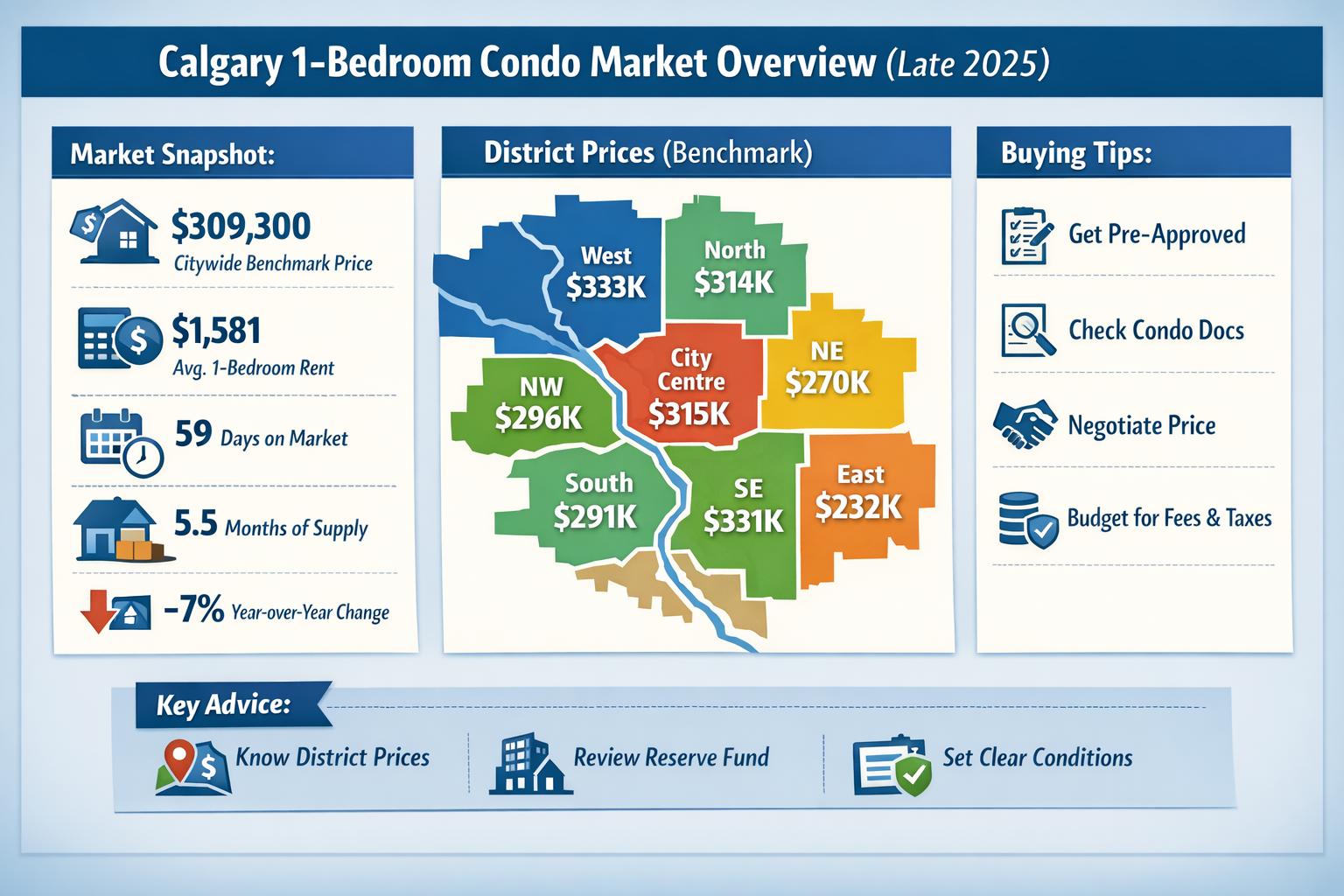

For the City of Calgary condo/apartment segment (which is the closest official market category to most 1-bedroom condos), late-2025 numbers show a more buyer-friendly environment than a tight market:

- Benchmark price (citywide): about $309,300

- Median price: about $298,800

- Average price: about $359,761

- Days on market: about 59 days

- Months of supply: about 5.50 months

- Year-over-year benchmark movement: around -7%

How to read these numbers as a buyer

- The “center of gravity” for many 1-bedroom condos is around $300k, but the building and location can push you above or below.

- Average price is higher than median because some units are bigger/newer/more premium—so don’t use average price as your main target.

- 59 days on market and 5.5 months of supply usually mean more choices and more negotiation potential, especially for units that aren’t perfectly priced.

3) Prices by district: where the budget changes fast

Calgary condo benchmarks vary dramatically by district. Here’s the late-2025 benchmark picture (apartment/condo category) to help you choose your search zones:

Approximate condo benchmark by Calgary district (late 2025)

- East: ~$231,700

- North East: ~$269,500

- South: ~$290,600

- North West: ~$296,400

- North: ~$314,100

- City Centre: ~$315,400

- South East: ~$330,900

- West: ~$333,900

- Total city: ~$309,300

What this means in real life

- If your budget is around $240k–$280k, you’re often looking at East or North East (or older buildings elsewhere).

- If your budget is around $290k–$320k, you’re in the South, North West, North, or City Centre range depending on building type and fees.

- If your budget is around $330k+, you’re often in the West or South East, or you’re paying for a stronger building, better location, or newer construction.

4) Negotiation leverage: months of supply is your secret weapon

Months of supply tells you how much inventory exists relative to sales—basically how hard sellers must compete for buyers.

Late-2025 district supply patterns suggest:

- West is relatively tighter (harder to negotiate aggressively).

- South East is one of the softest in supply (often best negotiation room).

- Several districts sit around the “buyer-friendly” zone where conditional offers and price negotiation are realistic.

Practical negotiation rules

- If supply is near 4 months or lower: be decisive on great units, use clean offers.

- If supply is around 5–6 months: negotiate; ask for conditions; compare alternatives.

- If supply is 7+ months: you’re in a strong position—be selective and negotiate harder.

5) Rent reality check: helps you judge your monthly “pain limit”

Even if you’re not buying as an investor, rent tells you what the market “pays” for a 1-bedroom lifestyle.

Late-2025 Calgary average 1-bedroom rent is roughly $1,581/month.

How to use this

- If your all-in ownership cost is far above this, you’re paying a premium for ownership, stability, and long-term upside—still valid, but you must accept the trade-off.

- If your ownership cost is near this (or only slightly higher), the purchase often “feels” financially easier to justify.

6) The real monthly cost of owning a 1-bedroom condo (not just the mortgage)

Your monthly ownership cost is usually:

- Mortgage payment

- Condo fees (this can be a huge number—treat it like a second payment)

- Property tax (depends on assessed value and city rates)

- Insurance (unit owner policy; building insurance is usually part of condo structure but deductibles matter)

- Utilities (some included in condo fees, some not)

The “condo fee trap”

A condo that looks cheap can become expensive if fees are high or rising. Two condos with the same price can have totally different monthly costs because of condo fees and taxes.

7) Financing basics you must know before shopping seriously

Minimum down payment

For purchase prices up to $500,000, the minimum down payment is typically 5%.

Stress test

You qualify at a higher “test” rate (the higher of a fixed floor rate or your contract rate plus a buffer). This reduces the maximum price you can buy compared to what you might think you can afford.

Buyer rule: get a real pre-approval and build your search price from what you can qualify for, not from what you hope the payment will be.

8) Closing costs: the expenses people forget

Beyond down payment, typical buyer closing costs include:

- Land titles registration fees (transfer + mortgage registration)

- Lawyer fees and disbursements

- Condo document fees (and ideally paid review)

- Home inspection (where appropriate)

- Moving and setup costs

Buyer rule: don’t spend every last dollar on down payment. Keep a buffer for closing and surprises.

9) The #1 make-or-break factor: condo documents and reserve fund health

This is where most condo “bad deals” hide.

Documents you should always request and review

- Condo bylaws and rules (pets, rentals, smoking, renovations, short-term rental restrictions)

- Financial statements and budget

- Board minutes (at least the past 12 months; 24 is even better)

- Reserve fund study/report/plan

- Insurance summary and deductible details

- Estoppel/status certificate (confirms fees, arrears, and key disclosures)

What to look for (red flags)

- Reserve fund is low or the plan looks unrealistic for upcoming repairs

- Frequent mention of water intrusion, building envelope issues, elevator/boiler problems

- Repeated special assessments in the past

- Big insurance deductibles that could fall on owners in certain damage events

- Chronic “fee increases” with no clear improvement plan

- Litigation or unresolved disputes involving the corporation

Buyer rule: a “cheap” condo with weak documents can become the most expensive property you ever buy.

10) Best buyer strategy for a 1-bedroom condo in Calgary (step-by-step)

Step 1: Decide your non-negotiables (write them down)

Examples:

- Max condo fee you will accept

- Parking required or not

- Minimum size and layout priorities

- Pet rules (if you have one now or might in the future)

- Rental flexibility (even if you plan to live there—life changes)

Step 2: Pick 2–3 target districts based on your realistic budget

Use the benchmark table as your “starting map.” Then filter by building quality and fee levels.

Step 3: Get pre-approved and respect the stress test

Your “bank-approved ceiling” prevents heartbreak and wasted time.

Step 4: Shortlist buildings, not just listings

Buildings develop reputations for fees, management quality, noise, maintenance, and special assessments. A great building is often worth paying a bit more for.

Step 5: Offer with the right protective conditions

In condo purchases, two conditions are usually essential:

- Condition on financing

- Condition on condo document review

Step 6: Review condo docs like an investigator

You’re hunting for hidden future costs. If you see signs of major upcoming repairs without funding, renegotiate or walk.

Step 7: Calculate your true monthly cost before removing conditions

Mortgage + condo fees + tax + insurance + utilities not included. Then compare that number to your comfort limit and to the rent market.

Step 8: Negotiate smartly

Use days on market and the supply level of the area. If a unit has sat for weeks, that’s your leverage—especially if there are similar units nearby.

Step 9: Close with a buffer

After closing, you want cash available for move-in issues, small repairs, furniture, and unexpected condo surprises.

11) Where to look depending on your goal

If you want city lifestyle (walkability, downtown access)

City Centre can match a ~$315k benchmark level, but you must be strict about condo fees and building health.

If you want maximum value and negotiation room

East and North East benchmark levels are lower, and supply can be more buyer-friendly. Just do deeper document checks—older buildings can hide maintenance risk.

If you want stronger demand pockets

West tends to be tighter in supply, meaning the best units can be more competitive.

If you want newer suburban product with selection

South East can have strong selection. Compare multiple similar units and negotiate on price and conditions.

Conclusion: what a “smart buy” looks like in late 2025

Late 2025 conditions in Calgary’s condo/apartment segment suggest:

- Prices are around the $300k benchmark zone citywide

- Supply is moderate, giving buyers more choice

- Properties take longer to sell, which often increases negotiation room

A smart 1-bedroom condo purchase in Calgary is not about finding the cutest kitchen. It’s about buying a solid building with healthy finances, reasonable fees, and clean documents—at a price that matches the district and current market conditions.

If you combine:

- district benchmark thinking,

- realistic financing limits, and

- serious condo document review,

you will buy smarter than most condo buyers in the city.